Exercitation ullamco laboris nis aliquip sed conseqrure dolorn repreh deris ptate velit ecepteur duis.

Get in touch

- The Source, Global Reach, Cardiff, CF11 0SN

- [email protected]

- 02920 265265

- Monday to Friday: 8.30am to 5pm

Error: Contact form not found.

- The Source, Global Reach, Cardiff, CF11 0SN

- Support 02920 265265

It's Still Us... We've Just Evolved.

We've worked with over 100 advisers across the market to deliver updates that support you with your general insurance business. Think customisation, added control and flexibility over the quoting process, all wrapped into a familiar look.

Not yet registered? Join 1000s of advisers already experiencing the Source systems!

It’s still us, we’re just giving you EVEN better tools!

Discover unparalleled flexibility with customisation options, effortlessly share quotes with our streamlined quote sharing feature, and leverage the cutting-edge capabilities of the Premium Predictor and Premium Saver functions.

Upgrade to a smarter, super-charged quoting experience with our latest enhancements!

Customisation Tools

Unleash the power of customisation as you sculpt the quoting process to perfectly align with your preferences.

Select how you experience:

The Panel – View the top 1, 3 or full panel of providers.

Declarations – Go step by step or access a full list of declarations.

You can set these preferences in your settings, this will then become your default experience every time you quote. Change as often or as infrequently as you want!

Customise your way.

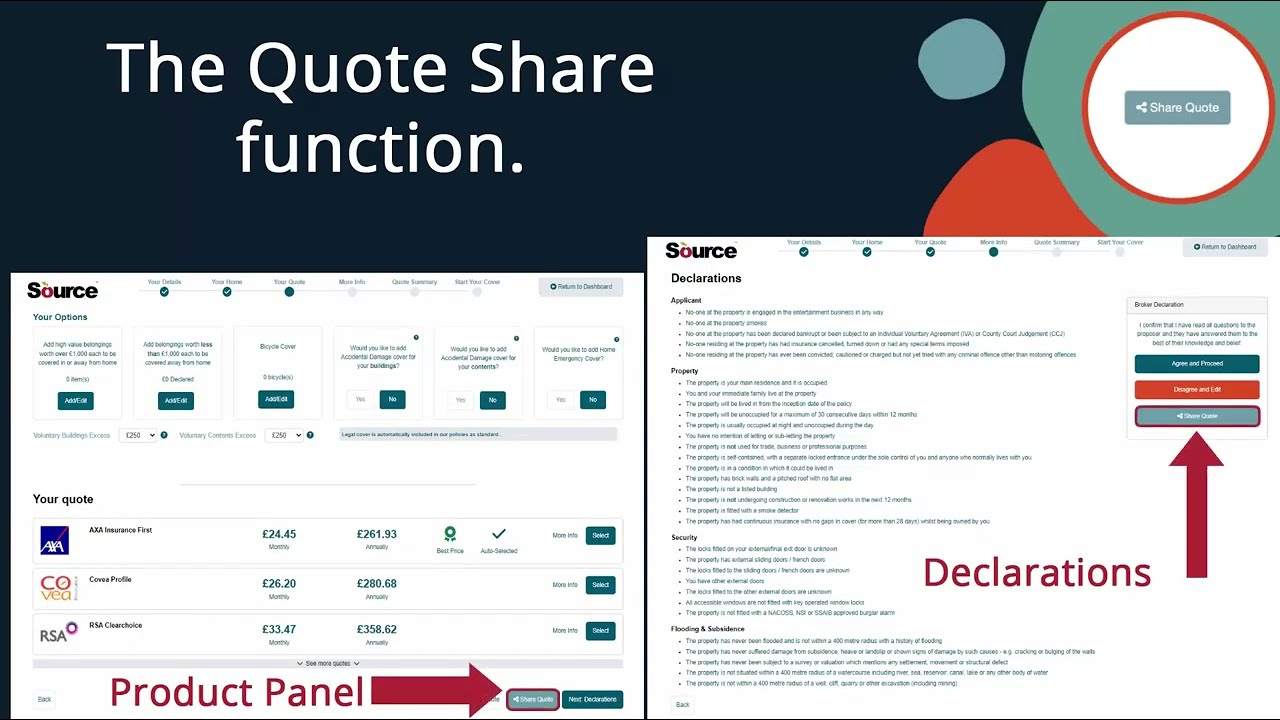

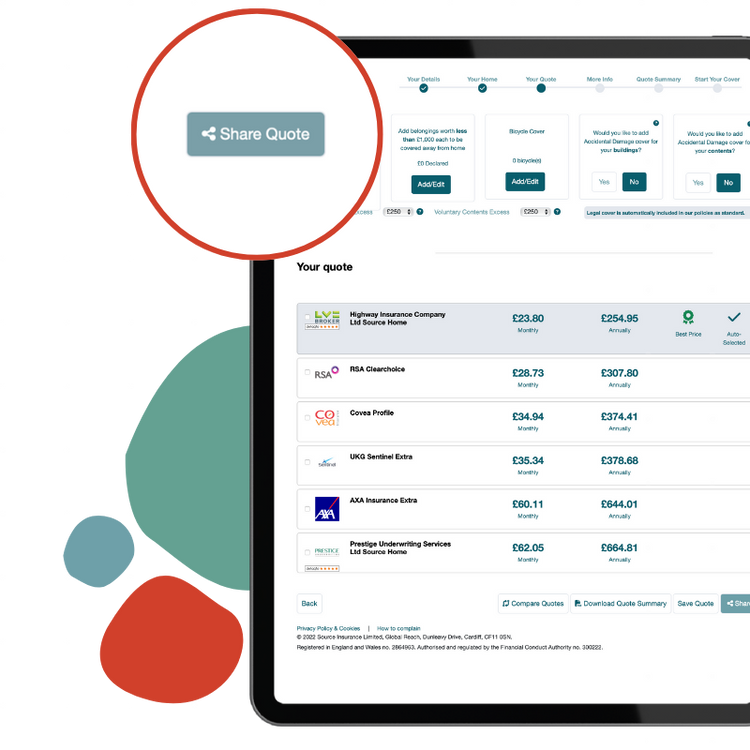

‘Share Quote’ Function

Give your clients the option to take charge of specific sections of the quotation process.

Share at declaration or payment stage for partial or full completion of the policy (assuming there are no premium-bearing amendments).

Should the premium change at declaration stage, the quote will be returned to you for final sign off in all instances.

Premium Predictor

Almost as accurate as a mystic crystal ball, our new Premium Predictor function means you can estimate a price at the click of a button.

Using data powered by Whenfresh, our predictor is super charged with high-quality property and risk data.

This pricing is indicative and based on averages within the postcode area.

Use this function to price a ranging shot for your clients – it’s quick, easy and hassle-free.

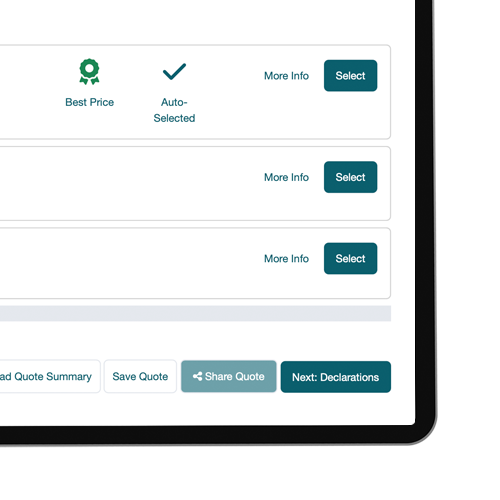

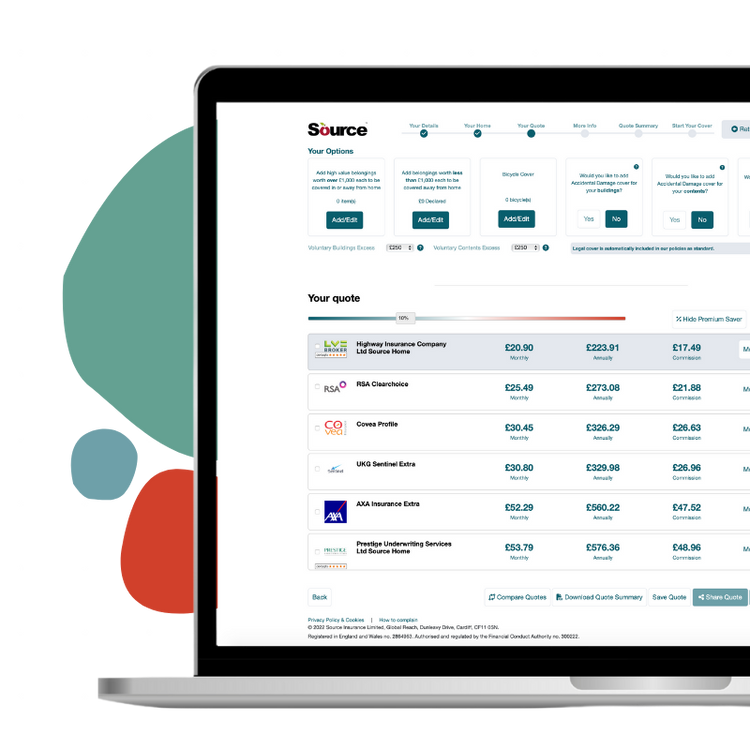

Alter the price of quotes in real time with our sliding flexible commission bar.

Use our slider to view the changes to annual, monthly and commission payments at a glance.

Hide or view this section by opening ‘Premium Saver’.

Our commission guarantee

Example: £340 Premium, 27.5% Commission, 90% Retention

You’ll earn competitive and flexible commission for the lifetime of each policy placed with Source.

For every year that your client renews with Source, you’ll continue to receive commission, even if you retire or leave the industry.

Set your default preferred commission percentage, between 0% and 27.5%, or use our sliding-scale to amend your commission rate at the end of each quote, to suit your client’s individual needs and budget.

Our Small but mighty Features

Quote Multi-Save

- Access multiple versions of your quote

- Never lose a premium

- Never lose quote progress with autosave built in

Copy Function

- Duplicate a quote including all data up until the declaration pages

- Quickly produce more than one quote for a client

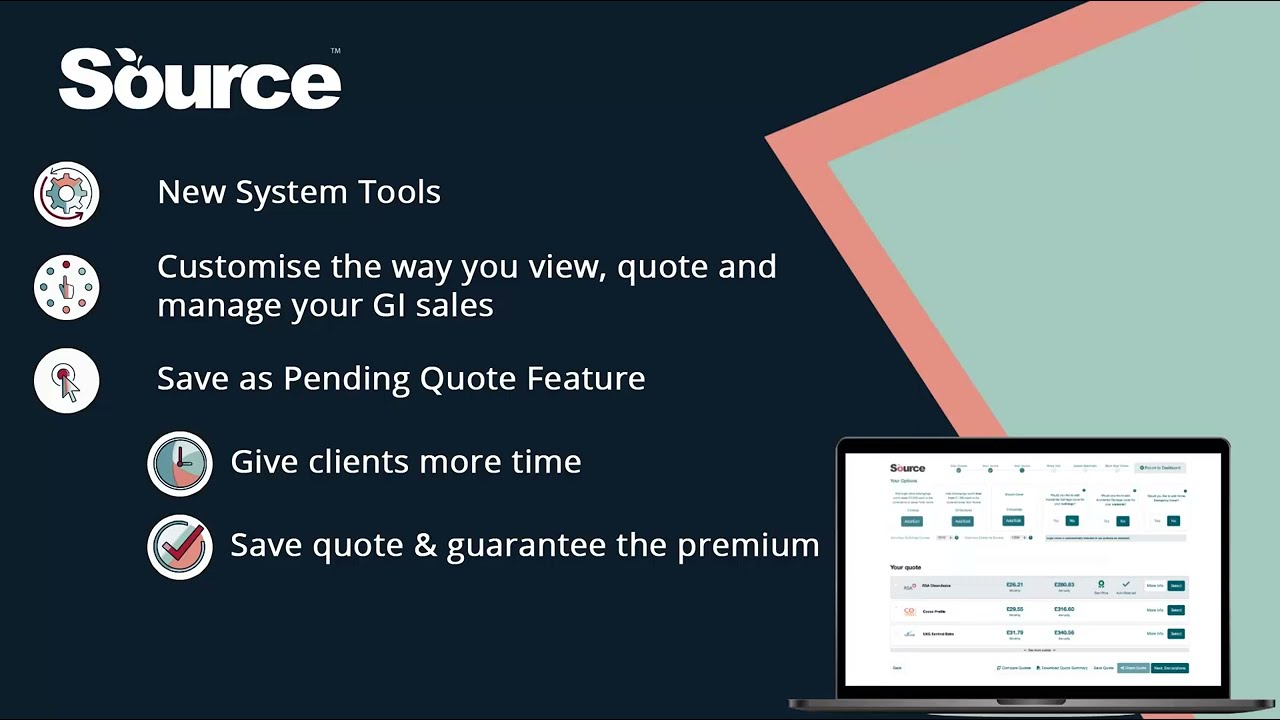

Save as Pending Quote

The Save as Pending Quote function allows you to save a pending quote, so your clients have more time to complete their quote and make their decision,

Compare Quote Companion

The Compare Quote feature lets you seamlessly evaluate multiple quotes side by side. Make informed cover choices, providing your clients with tailored solutions.