Exercitation ullamco laboris nis aliquip sed conseqrure dolorn repreh deris ptate velit ecepteur duis.

Get in touch

- The Source, Global Reach, Cardiff, CF11 0SN

- [email protected]

- 02920 265265

- Monday to Friday: 8.30am to 5pm

Error: Contact form not found.

- The Source, Global Reach, Cardiff, CF11 0SN

- Support 02920 265265

Tag: insurance

-

Source Insurance > insurance

Home Insurance Premiums – Why Do They Keep Rising?

It’s fair to say that the last 24 months have seen a significant increase in the cost of purchasing Home Insurance and although those increases have slowed down, we are yet to have ‘turned the corner’.

Expanding Your Online Reputation – A Starter Guide to Digital Marketing

There is a gap in the virtual market for you to appeal to an audience in need of sound financial guidance.

9 in 10 young followers have been encouraged to change their financial behaviour – a case of potentially misplaced trust.

Why Price Isn’t Always King

In 2023 alone, home insurance prices rose by an average of 40%, with many customers experiencing prices north of these averages. However, 2024, so far, is shaping up to be a better year for customers, regardless of continued price rises.

Source Insurance Joins The Money Group’s GI Panel

Award-winning GI intermediary Source Insurance have joined the GI panel at the Appointed Representative network, The Money Group.

OMS integrates with Source Insurance to enhance GI user experience

One Mortgage System (OMS) has announced a full application programming interface (API) integration with Source Insurance to enhance its users general insurance experience.

Top 5 Steps: Integrating GI Into Your Client Journey

Advisers constantly battle aggregators to offer competitive premiums to their customers. Understandably, clients often find it difficult to decipher which product offers sufficient coverage (for a reasonable price).

Source Insurance – Our Product Enhancements

With The Source, our new quote and buy system, alongside Source Home, our new in-house product, we’re doing our best to combat specific obstacles currently standing tall in the financial industry.

Market Update for 2024 – What to Expect

We’ve seen patterns that suggest 2024 will continue along the same path, with re-mortgaging the primary source of income for many advisers around the country. Now seems the appropriate time to look at the industry’s current obstacles and the impending trajectory for the rest of the year.

Collaborating With Our Advisers – Why Working Together is Paramount

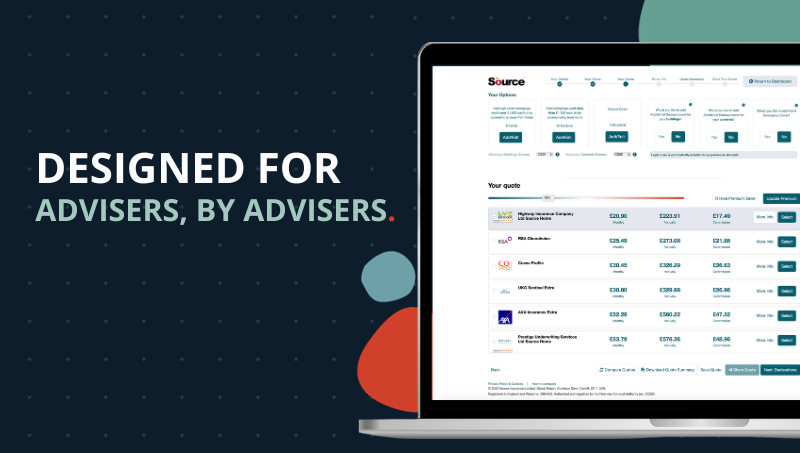

“In today’s rapidly evolving insurance landscape, the need for flexibility and adaptability has never been more critical. With the busy lives of advisers and their customers requiring more versatility, this article takes a look at the development of The Source – technology built with advisers for advisers!”

The Source: About Our New System

Our system boasts unique features, both big and small, that have all been specially designed to help you in your endeavours. They all play a part in providing your customers with a straightforward, hassle-free way of finding their ideal home protection.

Recent Posts

- AI for Advisers | From Paperwork to People: How Technology Gave Advisers Their Time Back

- Source Donates Christmas Marketing Budget

- 2026 Mortgage Market Predictions

- Source Insurance partners with ActiveQuote to Deliver New PMI Referral Opportunity for Advisers

- Landlords are bracing themselves; their tenants just got mortgage offers!