Exercitation ullamco laboris nis aliquip sed conseqrure dolorn repreh deris ptate velit ecepteur duis.

Get in touch

- The Source, Global Reach, Cardiff, CF11 0SN

- [email protected]

- 02920 265265

- Monday to Friday: 8.30am to 5pm

Error: Contact form not found.

- The Source, Global Reach, Cardiff, CF11 0SN

- Support 02920 265265

Tag: brokers

-

Source Insurance > brokers

Why Being a Consumer Champion is the Best Title You Can Hold

As you know, becoming a Consumer Champion doesn’t happen overnight. It takes years of experience to build a trusted reputation in the Financial Services industry.

OMS integrates with Source Insurance to enhance GI user experience

One Mortgage System (OMS) has announced a full application programming interface (API) integration with Source Insurance to enhance its users general insurance experience.

Source Insurance – Our Product Enhancements

With The Source, our new quote and buy system, alongside Source Home, our new in-house product, we’re doing our best to combat specific obstacles currently standing tall in the financial industry.

Market Update for 2024 – What to Expect

We’ve seen patterns that suggest 2024 will continue along the same path, with re-mortgaging the primary source of income for many advisers around the country. Now seems the appropriate time to look at the industry’s current obstacles and the impending trajectory for the rest of the year.

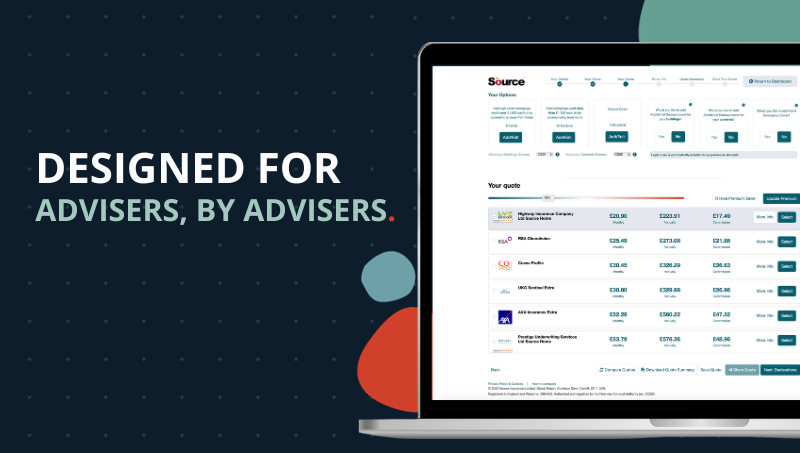

The Source: About Our New System

Our system boasts unique features, both big and small, that have all been specially designed to help you in your endeavours. They all play a part in providing your customers with a straightforward, hassle-free way of finding their ideal home protection.

Are Ancillary Products the Way Forward in the Current Market?

The latest property market data shows that with a clear pattern emerging, homeowners can plan ahead and build the shield to prevent unexpected losses of income or assets.

“Life is Like a Box of Chocolates…”

Vulnerability is not new, although the use of that label has taken on a new significance in recent years. The FCA talking about Vulnerable Customers is not new either – launching their first consultation on the subject in 2019 and publishing their industry-wide regulatory guidance in February 2021.

Re-mortgage Monthly Searches Hit Record High with 21.9% Increase in June

In the month of June, the monthly searches for re-mortgaging took a significant leap, with a nearly 22% increase on the previous month. This was revealed in exclusive data from Twenty7tec. On top of this, purchase mortgage searches increased by 0.6%, along with buy-to-let searches rising by 11% when compared to May 2023.

Buy-to-Let Market Expecting Severe Interest Rate Hike Amidst Rigid Inflation

Economic forecasts released on Monday, 12th June, have predicted a continuation of interest rates, despite a more optimistic bigger picture. Although many may be hopeful for more economic stability on the horizon, there may be a considerably longer period for lethargic growth in the financial market.

Preparing for the Rise of Gen Z in the Property Market

The world as we know it has transformed into an age of technology and digital advancements, with younger age groups at the heart of this dynamic shift. As a result, the financial services industry has undergone significant changes in recent years, significantly driven by the influence of the tech-savvy generations, such as Gen Z. Evolve ahead of the curve, so you’re one step ahead of the competition, ready to meet your clients’ needs.